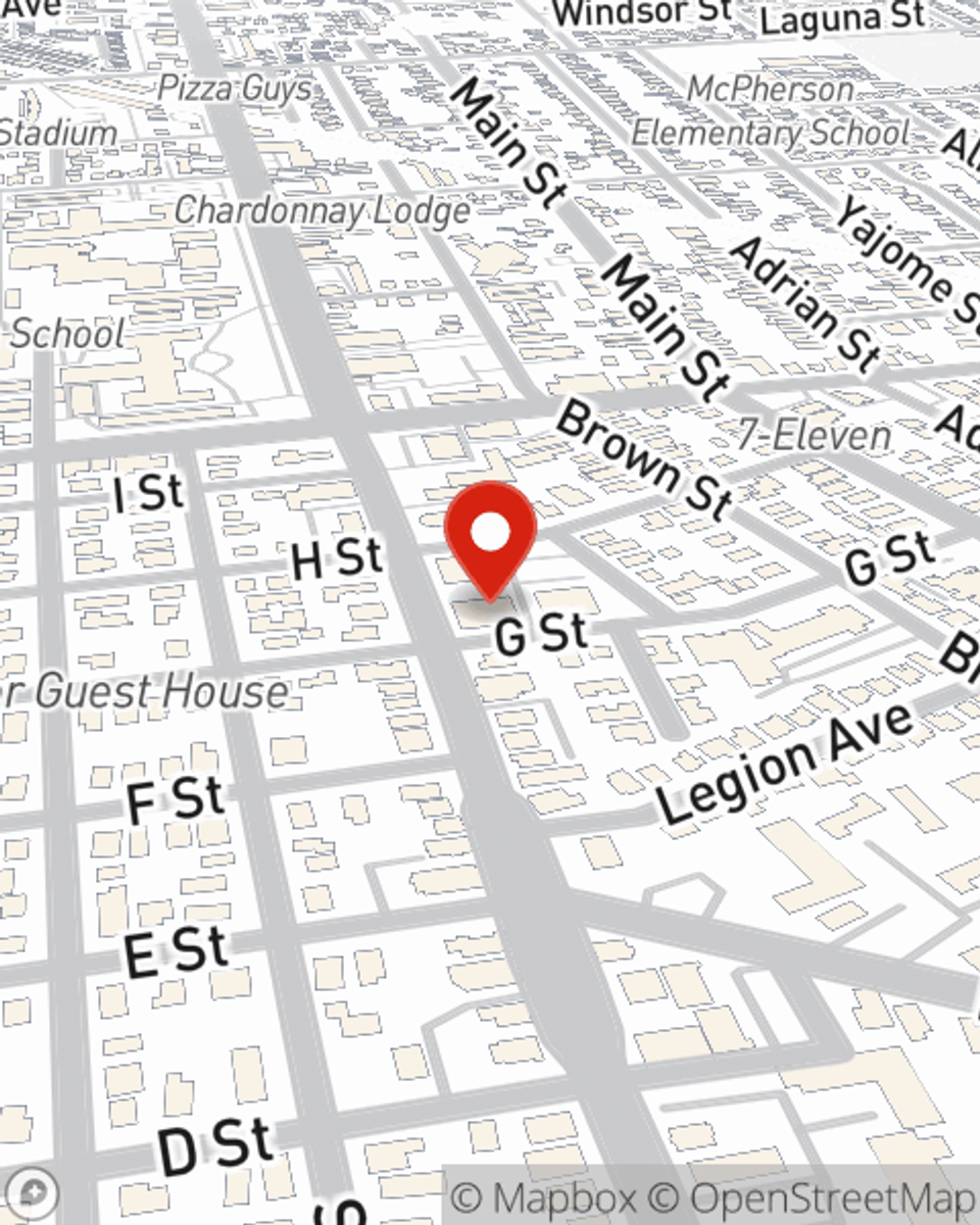

Business Insurance in and around Napa

Looking for small business insurance coverage?

Helping insure small businesses since 1935

- Napa

- Yountville

- St. Helena

- American Canyon

- Calistoga

- Benicia

- Sonoma

- Vallejo

- Fairfield

- Vacaville

- Petaluma

- Santa Rosa

- Suisun

- Lake Barryessa

- Green Valley

- Glen Ellen

- Kenwood

- Angwin

- Hercules

- Concord

- Martinez

- sacramento

- contra costa

- Monterey

Help Protect Your Business With State Farm.

Do you own a HVAC company, a pharmacy or a pet groomer? You're in the right place! Finding the right insurance for you shouldn't be risky business so you can focus on your next steps.

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Insurance Designed For Small Business

You are dedicated to your small business like State Farm is dedicated to dependable insurance. That's why it only makes sense to check out their coverage offerings for surety and fidelity bonds, artisan and service contractors or worker’s compensation.

As a small business owner as well, agent John Cardinale understands that there is a lot on your plate. Visit John Cardinale today to talk over your options.

Simple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

John Cardinale

State Farm® Insurance AgentSimple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.